Contents

Use automation to find better trades, eliminate mistakes and manage your investments – even while you’re away from the computer. Minimal RSI swing trading bot for small accounts with no overlapping positions. A classic bot strategy that scans for high IVR in a basket of tickers and sells wide iron condors. Automated trading BOT template that opens an Iron Condor in SPY twice a week with an 80% chance of profit.

The seller profits if the call expires out of the money because they would keep your premium. This CORE intermediate long call spread sample bot template is designed for traders who have a basic understanding of options trading and the autotrading platform. Options trading entails significant risk and is not appropriate for all investors. Before trading options, please read Characteristics and Risks of Standardized Options.

The https://forex-trend.net/ position does not need to be the same strategy as the default position. Besides strike and initial price, you can also change each leg’s instrument type and position size. The goal is for the stock to be below strike A, which allows both calls to expire worthless. Time-decay is helpful while it is profitable, but harmful when it is losing. More updatesIV is now based on the stock’s market-hours price – This should reduce the deviation of IV if the stock moves significantly after options trading has closed. When you buy a call option, you are also known as long in the call option.

- This way, you can compare the bull call spread to a $45 strike long call , to a ladder or ratio spread.

- Bull call spreads can be adjusted like most options strategies but will almost always come at more cost and, therefore, add risk to the trade and extend the break-even point.

- This requires paying another debit and will increase the risk, but will extend the duration of the trade.

- The option strategy expires worthlessly, and the investor loses the net premium paid at the onset.

A bull call debit spread is entered when the buyer believes the underlying asset price will increase before the expiration date. Bull call spreads are also known as call debit spreads because they require paying a debit at trade entry. The further out-of-the-money the bull call debit spread is initiated, the more aggressive the outlook. The net vega is slightly positive, because the vega of the long call is slightly greater than the vega of the short call. As expiration approaches, the net vega of the spread approaches the vega of the long call, because the vega of the short call approaches zero.

However, the additional debit spread will cost money and extend the break-even point. If the stock price is below the long call option at expiration, both options will expire worthless, and the full loss of the original debit paid will be realized. Bull call debit spreads have a finite amount of time to be profitable and have multiple factors working against their success. If the underlying stock does not move far enough, fast enough, or volatility decreases, the spread will lose value rapidly and result in a loss.

A call gives the buyer the right, but not the obligation, to buy the underlying stock at strike price A. However, you can simply buy and sell a call before it expires to profit off the price change. As most government bonds are deemed credit risk-free, they are used as a benchmark which corporate bonds are compared against. The wider the credit spread, the worse the company’s credit quality. When a company’s credit quality drops, credit spread widening will happen to reflect the required return investors demand. It is difficult to understand what is a credit spread without first understanding the meaning of yield to maturity .

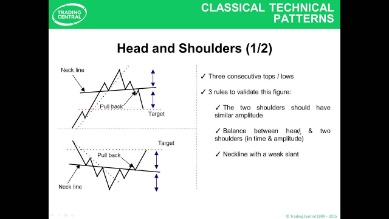

What is a bear call spread?

Bull call spread typically has one break-even point somewhere between the two strikes – in our example at underlying price of $47.36 , which is -0.65% from the current underlying price . The position sizes of the long and short call option should be the same, only with opposite signs (+3 contracts for leg 1 and -3 contracts for leg 2). Call Option Calculator is used to calculating the total profit or loss for your call options. The long call calculator will show you whether or not your options are at the money, in the money, or out of the money. Use an at-the-money strike to make this strategy neutral, or a slightly out-of-the-money or in-the-money strike to give a bullish or bearish bias. Note that this is a bearish strategy that profits from a stock fall.

This article will help you to understand what is a credit spread with the credit spread definition. We will also demonstrate how to calculate the credit spread of a company using the appropriate formula. This article will also include an example to help you understand how to implement the a credit spread strategy in real life. Note, also, that whichever method is used to close the short stock position, the date of the stock purchase will be one day later than the date of the short sale.

You will need the concepts explained there to navigate through this calculator. Multi-strategy bot that uses technical indicators to determine trend and hedging to cover outstanding risk. Opens a Debit Spread ATM Long Call & Nearest Short Call & DTE for 20%+ profit same day or overnight. This lesson explains the pros and cons of call spreads and put spreads. Greeks are mathematical calculations used to determine the effect of various factors on options.

Learn trading tips & strategiesfrom Ally Invest’s experts

If the https://topforexnews.org/ price is above the strike price when the position is established, then the forecast must be for the stock price to fall to the strike price at expiration . If the stock price is below the strike price when the position is established, then the forecast must be for the stock price to rise to the strike price at expiration . With a bull call spread, the losses are limited reducing the risk involved since the investor can only lose the net cost to create the spread. However, the downside to the strategy is that the gains are limited as well. After the strategy is established, the effect of implied volatility depends on where the stock is relative to your strike prices. The vertical bear call spread, or simply bear call spread, is employed by the option trader who believes that the price of the underlying security will fall before the call options expire.

Potential profit is limited to the difference between strike A and strike B minus the net debit paid. The above value and P/L only applies if the underlying ends up precisely at $47.67 at expiration. A more complete overview of P/L at various prices is available on the right, in cells K8-N18. It shows the position’s total P/L at each strike and break-even point.

In this https://en.forexbrokerslist.site/ put spread example, you profit if the stock price falls and ends below the breakeven price. A strong bearish signal of the company’s current status is when the operating cash flow starts to decrease. It is a bearish strategy meaning you will profit from a stock fall in price. Here you will have to sell a call option with a lower strike price and to buy a call option with a higher strike price.

Should the underlying asset fall to less than the strike price, the holder will not buy the stock but will lose the value of the premium at expiration. If the share price moves above the strike price the holder may decide to purchase shares at that price but are under no obligation to do so. Again, in this scenario, the holder would be out the price of the premium. A bull call spread is an options strategy used when a trader is betting that a stock will have a limited increase in its price. A bearish vertical spread strategy which has limited risk and reward.

KISS n Sleep Iron Butterfly

Use the Profit + Loss Calculator to establish break-even points, evaluate how your strategy might change as expiration approaches, and analyze the Option Greeks. You want the stock to be at or above strike B at expiration, but not so far that you’re disappointed you didn’t simply buy a call on the underlying stock. But look on the bright side if that does happen — you played it smart and made a profit, and that’s always a good thing. Use the Profit + Loss Calculator to estimate break-even points, evaluate how your strategy might change as expiration approaches, and analyze the Option Greeks. The motivation of the strategy is to generate a profit if the stock rises, but make the strategy cheaper than simply buying a call option.

A long calendar spread with calls is created by buying one “longer-term” call and selling one “shorter-term” call with the same strike price. In the example a two-month 100 Call is purchased and a one-month 100 Call is sold. This strategy is established for a net debit , and both the profit potential and risk are limited. A bull call debit spread is made up of a long call option with a short call option sold at a higher strike price.

Buy a call option for a strike price above the current market with a specific expiration date and pay the premium. Use the Profit + Loss Calculator to estimate profit potential by determining what the back-month option will be trading for at the expiration of the front month. Potential profit is limited to the premium received for the back-month call minus the cost to buy back the front-month call, minus the net debit paid to establish the position. For this Playbook, I’m using the example of a one-month calendar spread. If you’re going to use more than a one-month interval between the front-month and back-month options, you need to understand the ins and outs of rolling an option position.

The maximum profit potential is the spread width minus the premium paid. To break even on the position, the stock price must be above the long call option by at least the cost to enter the position. Long calendar spreads with calls are frequently compared to short straddles and short strangles, because all three strategies profit from “low volatility” in the underlying stock.

Trendy Short Put Spread

The short call will have a higher premium to be collected, and the long call will have a lower premium to be paid, creating an initial profit called net credit. Remember that when you are long in an option, you pay a premium , and when you are short, you receive a premium . Because stocks do not have an upper limit, your losses can be infinite if you are short in a call option.

Consequently, when we combine being long and short in calls and puts, we pay a premium in our long positions and receive a premium when short. It is the characteristics of each contract that defines a limited maximum profit and a maximum loss. If assignment is deemed likely and if a short stock position is not wanted, then appropriate action must be taken.

Bull call spreads can be adjusted like most options strategies but will almost always come at more cost and, therefore, add risk to the trade and extend the break-even point. The time value of the long option contract decreases exponentially every day. Ideally, a large move up in the underlying stock price occurs quickly, and an investor can capitalize on all the remaining extrinsic time value by exiting the position.

A fully automated iron condor strategy built specifically for small portfolios around $3k. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes only. You can use our calculator above, which uses the Black Scholes formula to estimate the value of a long call purchase before or at expiry. Legs 3 and 4 are unused; their instrument types should be set to None .