Contents

Sometimes business receives partial payment from its customers and is unsure about which invoice are paid. In this respect, the partials payments hold in the suspense account until contact with the customers. When invoice reference is found, close the suspense account and moves the amount to the correct account.

When debits and credits don’t match, hold the difference in a suspense account until you correct it. A suspense account has a general ledger that you can use for the temporary recording of business transactions. The need for a suspense account arises when you are unable to identify the appropriate ledger account for the transactions which have been recorded. The amount of capital or transformation that is moved to the suspense account is for a brief period. You will need to do a proper investigation to determine the correct ledger account and where the amount should be moved or added. When you are looking to invest money, you can transfer your funds to a suspense account until you decide where to invest that capital.

When a bookkeeper is not sure where the transactions should be posted. In this case, the bookkeeper may enter the amount into suspense account as a pending transaction. When the right account is determined or the error is rectified, the amount shall be moved from the suspense account to its proper account. In such cases, a suspense account is created up to adjust the balance and continue with the trading, profit and loss account, and balance sheet. A suspense account gives you a temporary space for recording unambiguous transactions.

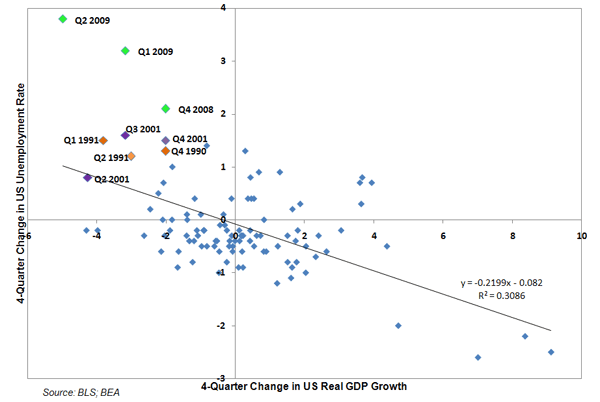

Time Value of Money

To match the debit and credit balances, you can hold the difference in the suspense account until it is corrected. No, you do not need to close your suspense account as long as you are keeping track of uncorrected transactions. If your business experiences a high rate of change in its accounts, though, it is best practice to close the suspense account periodically and transfer all uncorrected entries to their respective ledger accounts. The purpose of maintaining suspense accounts is to carry the doubtful amounts of which can either be a payment or a receipt and is recorded to equal the total debit and credit side of the Trial Balance.

Until you actually make the withdrawal from the agent or financial institution, the remittance money may be stored in their suspense account. Increases in expenses and losses are debits; decreases in expenses and losses are credits. Cash Rs.390 received from Geetha, though entered in the cashbook had not been posted to Geetha’s a/c. For freelancers and SMEs in the UK & Ireland, Debitoor adheres to all UK & Irish invoicing and accounting requirements and is approved by UK & Irish accountants. Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting. In the above-said example, this account will be treated as a liability account because it has a credit balance.

Suspense Account is a temporary ledger account, opened for putting the difference on shorter side of the trial balance. Sometimes, it is not possible to locate someone sided errors in-spite of taking all efforts for their detection. As trial balance is the basic input for preparation of final accounts, it is not possible to retain open trial balance till those errors were detected. Sometimes you may got full payment from your customers but you unsure who paid to your account. After getting the invoice reference and details of customers, you will close the suspense accounts and transfer the amount to appropriate heads. Trial Balance is the closing balance of an account which is prepared to know the arithmetical accuracy of the company.

Definitions and Steps of the Scientific Method

When the transaction classification has been determined, the amount needs to be transferred from the suspense account to the correct account. The main purpose of setting up a suspense account is to keep track of temporary transactions that have not yet been posted to the ledger account. These temporary transactions are «suspended» or held in suspense until they can be identified with a specific ledger account. A suspense account cannot have a debit balance, it always shows a credit balance.

Although recording the suspense is not considered a good sign for internal controls of the business. Still, it’s better to record an unclear transaction in the accounting record than to leave it at all. Otherwise, material and important information might be omitted and go unnoticed, which is, of course, not advisable from a user perspective. If you don’t know who made the payment, look at your outstanding customer invoices and find which one matches the payment amount. Contact the customer to verify that it’s their payment and the right invoice.

In investing, a suspense account is a type of brokerage account where a customer’s proceeds from selling an investment may be recorded until the customer uses the money to invest in something else. A suspense account is essentially a bookkeeping technique for keeping track of funds for a brief period until particular issues are resolved. A business can use a suspense account to record payments it has received but that can’t be properly accounted for until certain missing information is obtained.

What is a Suspense Account? A Basic Guide

If the credits in the trial balance exceed the debits, record the difference as a debit–and vice versa–to make both columns of the trial balance report balance. Money has been transferred to the bank of the supplier but has not yet been deposited into an account, or money has been received before a policy or contract has been signed. Booking of transactions before an allocation to the appropriate cost or profit centres.

These transactions include purchases, sales, receipts, and payments. When the business is unsure about the account in which they need to park a particular transaction, it is best to put the transaction in a suspense account and consult with your accountant before making any decision. For efficiency purposes, it is also helpful to track and analyze the entries over time to minimize the reoccurrence of any transactions that cause frequent unnecessary postings into the suspense account. The bookkeeper is unable to balance the company’s trial balance, with the credit column exceeding the debit side by $500. A customer paid an outstanding $1,000 invoice in two partial payments of $500. At times, all the required details for a particular transaction are not available but it still needs to be recorded in order to keep the accounting books updated.

- For suspense account journal entries, open a suspense account in your general ledger.

- So, we will post this transaction in the suspense account by credit this account.

- The need for a suspense account arises when you are unable to identify the appropriate ledger account for the transactions which have been recorded.

- Thus, nil balance in Suspense Accounts is the conclusive proof of absence of one-sided errors in the books of accounts.

- The suspense account can hold the difference that led to the trial balance not balancing until the discrepancy is rectified.

His accountant then reclassified the operation as a fixed asset purchase and the suspense account balance was removed. Trial balance is the basic input for preparation of final accounts. In case of disagreement of total of trial balance, the accountant puts the difference on the shorter side of the trial balance as ‘Suspense Account’ and proceeds for preparation of final accounts.

Of course, the suspense account is a temporary place to park money, not a vehicle! A suspense account is a place that temporarily holds unclassified funds while a company makes a decision as to where to put them permanently. Usually there is doubt or dispute as to where the funds belong, so they are parked temporarily in the suspense account.

There are times when the company receives money even before they make a contract or a policy. Lastly, there’s a transaction from an invalid account that has invoiced payments because of some issues. The term «suspense account» can have several different meanings, depending on the context. In the business world generally, a suspense account is a section of a company’s financial books where it can record ambiguous entries that need further analysis to determine their proper classification. In mortgage servicing, the servicer can use a suspense account to park funds temporarily if a borrower has made only a partial payment for that month.

Designed for freelancers and small business owners, Debitoor invoicing software makes it quick and easy to issue professional invoices and manage your business finances. It can be a repository for monetary transactions entered with invalid account numbers. If one of these conditions what is the nature of suspense account applies, the transaction should be directed to a suspense account. Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries.

They ensure that you account for all transactions accurately in your books. When the credit side of trial balance is larger than debit side, the difference will be shown in Debit side. When the debits side are larger, the difference will be shown in credit side. A suspense account is also known as a difference in book account or an error account. No, unlike mortgage escrow accounts, the money in a mortgage suspense account doesn’t earn any interest for the borrower. Similarly, if a borrower pays more than they owe for a particular month—without designating how those funds should be applied—the servicer may put the extra money into a suspense account for the time being.

How are Suspense Accounts used in the Real World?

A suspense account is a section in the general ledger which temporarily records transactions that are unclassified yet to be assigned to their proper destination. In other words, it is the general ledger account where you record transactions on a temporary basis. The transactions in the suspense account should be moved to their proper accounts as early as possible. Sometimes, at the time of closing, the account debit and credit in the trial balance do not match each other. To balance the TB and close the accounts, an accountant/bookkeeper may decide to close the TB and keep the balance in the suspense.

Example #2: You’re not sure how to classify a transaction

When we get to know the name of the Customer then we will transfer this transaction in the customer account. At the end of the month, his accountant had to reconcile the bakery’s ledgers but there was a bank transaction of $300 that he had no record off. In order to file the monthly tax report on time he put this amount in a suspense account and the ledgers were reconciled perfectly. When you record uncertain transactions in permanent accounts, you might have incorrect balances. Suspense accounts help you avoid recording transactions in the wrong accounts.

Otherwise, larger unreported transactions may not be recorded by the end of a reporting period, resulting in inaccurate financial results. A suspense account is an account used to temporarily store transactions for which there is uncertainty about where they should be recorded. Once the accounting staff investigates and clarifies the purpose of this type of transaction, it shifts the transaction out of the suspense account and into the correct account. When your trial balance is out of balance (i.e., the debits are larger than the creditsor vice versa) then the difference is held in a suspense account until the imbalance is corrected. As the trial balance is amended directly, only a one-sided journal entry into the suspense account is needed to record the difference. If the suspense account shows debit balance, it is shown in the asset side of the balance sheet.

Hence this account helped him to keep the transaction in books of accounts and, at the same time, deter him from putting it under the wrong category. Moreover, if the errors are located after the preparation of the Suspense Account, all those errors can be rectified only by means of suitable journal entries. Payments received with incorrect account information, insufficient https://1investing.in/ instructions on how to apply invoice payments or other difficulties that prohibit them from being posted normally. Unmatched amounts are clearly indicated, meaning you can go back and match them easily once you know where they belong. The suspense account is built-it, effectively allowing you to manage all transactions, even if they have not yet been categorised.